Seller Financing: A New Primitive for Selling and Buying NFTs

NFT markets have proven resilient relative to other digital assets over the 2022 bear market. Total NFT-collateralized loans have surged, floor perps passed $200M total volume, and NFT DeFi charts are pointing up and to the right, save one: NFT purchase financing. It remains small and stagnant.

In TradFi, financing and credit are table stakes for a dynamic economy. Yet, when it comes to NFTs, financing remains largely unused. To solve this, NiftyApes is launching Seller Financing for NFT sales. After NiftyApes Lending innovated on the secondary debt market, we turned to Seller Financing to reinvent NFT purchases.

Seller Financing is a positive-sum game for both sides of the NFT market. Sellers can access the financing they need to sell NFTs faster at the right price, with the protocol holding their assets in escrow over the lifespan of the financing. Buyers get flexible terms, low APRs and NFT utility the moment they click “buy.” They also have the ability to sell at any point during the lifespan of the loan.

Seller Financing is designed to work with every type of purchase, with every type of NFT. That’s why we've built an SDK to make it accessible and easy to integrate into any marketplace or project.

TradFi Thrives with Financing; Web3 Falls Short

30% of all purchases are made with credit. Over half of Americans use Buy-Now-Pay-Later (BNPL) services like Klarna or Affirm. Financing is a clear win for vendors, increasing size (+50%) and frequency (+20-40%) of sales for consumer goods.

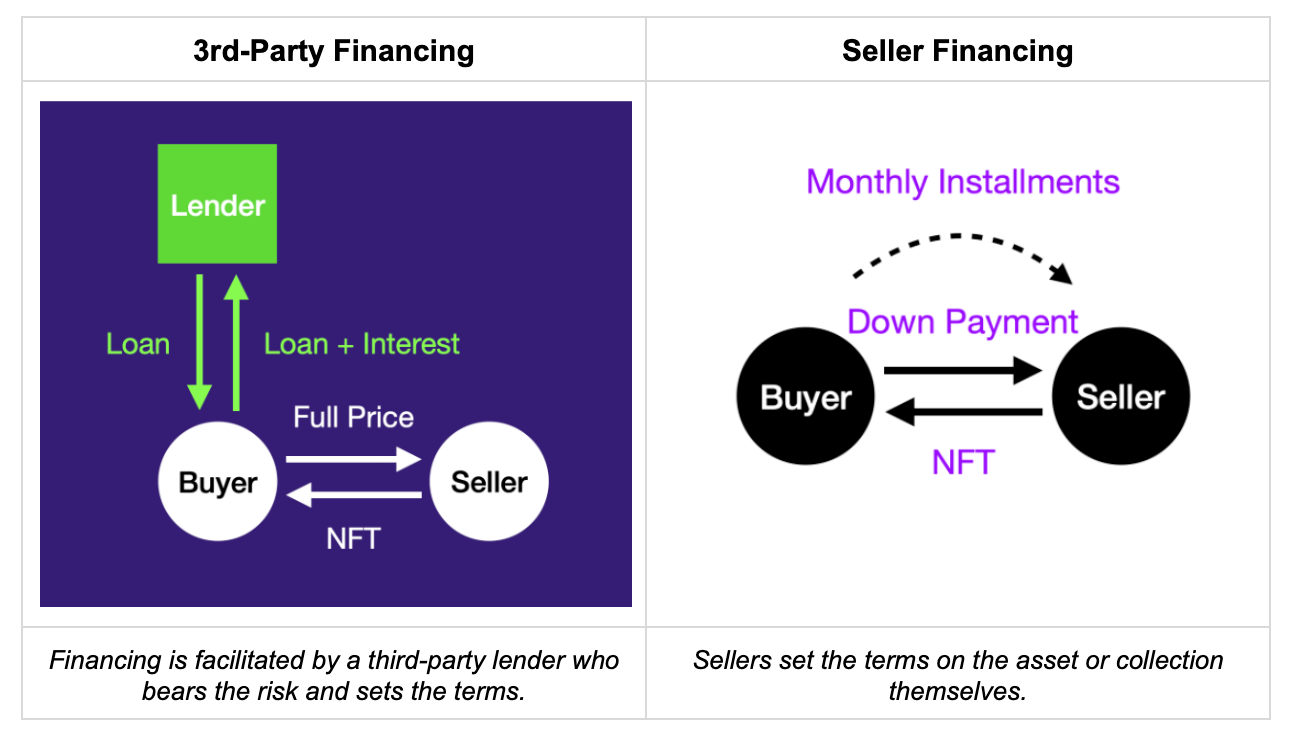

Meanwhile, financing options for NFTs have lagged, making purchase-with-financing slow, painful, or impossible. Financing is currently tethered to two things: 1) NFT collections that lenders are willing to lend against, and 2) the amount of capital lenders are willing to risk. Moreover, you can see from the table below how risk is priced not just into APRs, but also into down payment requirements and the loan’s duration.

*DeFi terms derived from loan offer averages found on Dune and DefiLlama

Financing fuels economic activity and enables investment and growth. The absence of accessible financing slows price discovery and makes the market less efficient.

Empowering NFT Buyers and Sellers: Financing Upgraded

Seller Financing takes the best of traditional finance and adapts it for the Web3 world, providing a trustless solution for NFT sales that offers greater security and flexibility. NFT sellers and buyers can enjoy the benefits of financing without having to rely on trust-based systems or third-party lenders.

With Seller Financing, sellers set the price and terms, and buyers can pay for their purchase over time and sell at any point during the financing period. It is the most capital-efficient form of financing, because it requires no lender capital to start.

How Seller Financing Works

- Listing: The seller lists an item for sale on the NFT marketplace and sets financing options (either custom or pre-made based on the sale price).

- Signing: The seller signs the transaction into the offer book, which is a record of all offers made on the marketplace.

- Purchase initiation: A buyer initiates the purchase by making a down payment on the NFT.

- Escrow transfer: The NFT is transferred to a neutral escrow contract to ensure a secure transaction.

- Ticket minting: A buyer and seller ticket is minted and sent to each wallet, representing both sides of the purchase.

- Ownership transfer: The buyer becomes the owner of the NFT and can start using it immediately after clicking "Buy" via delegate.cash.

- Payment: The buyer makes payments until the purchase is paid in full.

- NFT transfer: Once the purchase is paid in full, the NFT is transferred out of escrow to the buyer's wallet.

(For more details, see the FAQ on our website.)

Try It Today, Build With It Tomorrow

If you're interested in exploring the potential of Seller Financing, you can try it out today on either Goerli or Mainnet. Our Seller financing solution is built on a cutting-edge SDK, making it easy for developers to build and integrate it into their own projects.

If you're interested in learning how you can use our SDK to build your own Seller financing solutions, we'd be happy to schedule a call with you to discuss the possibilities.