NiftyApes FAQ

How does borrowing work on NiftyApes?

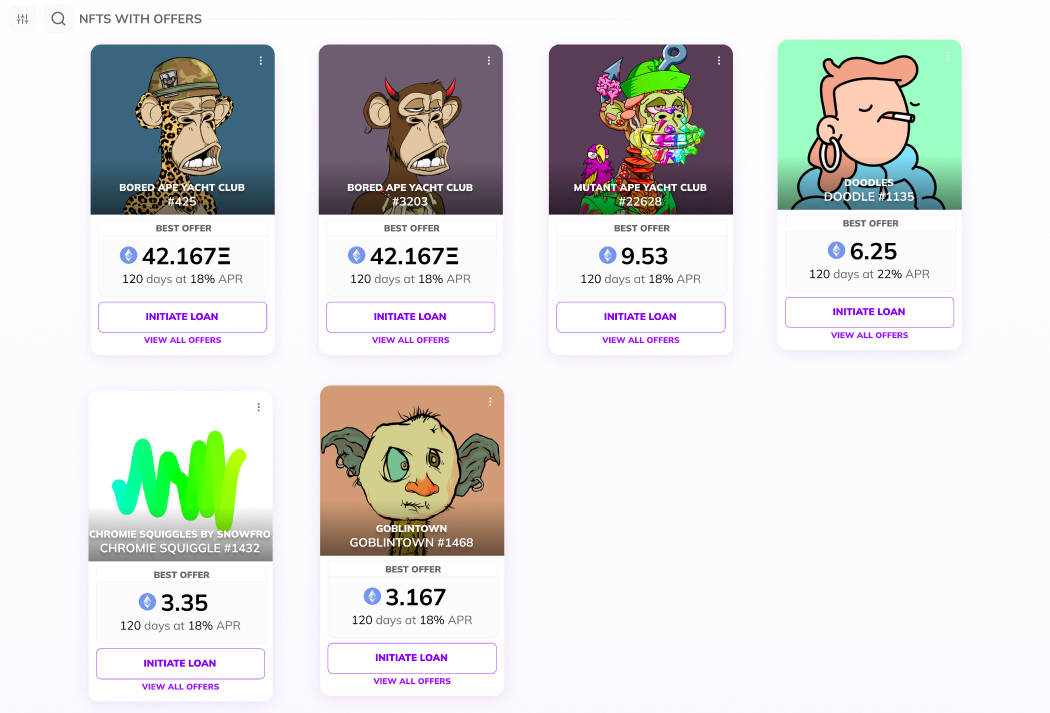

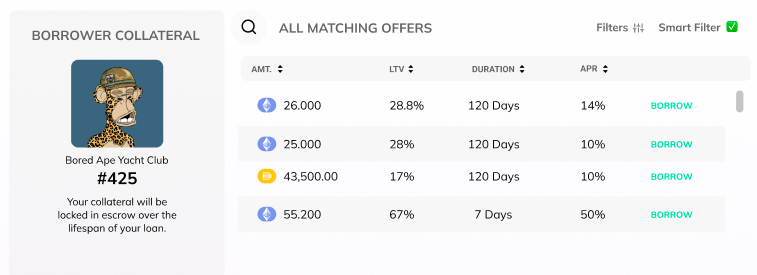

Borrowers can connect their wallets to the NiftyApes front-end. The NiftyApes front-end looks at the NFTs in the borrower’s wallet and displays the "top" loan based most liquidity available at the lowest interest rate for the longest time.

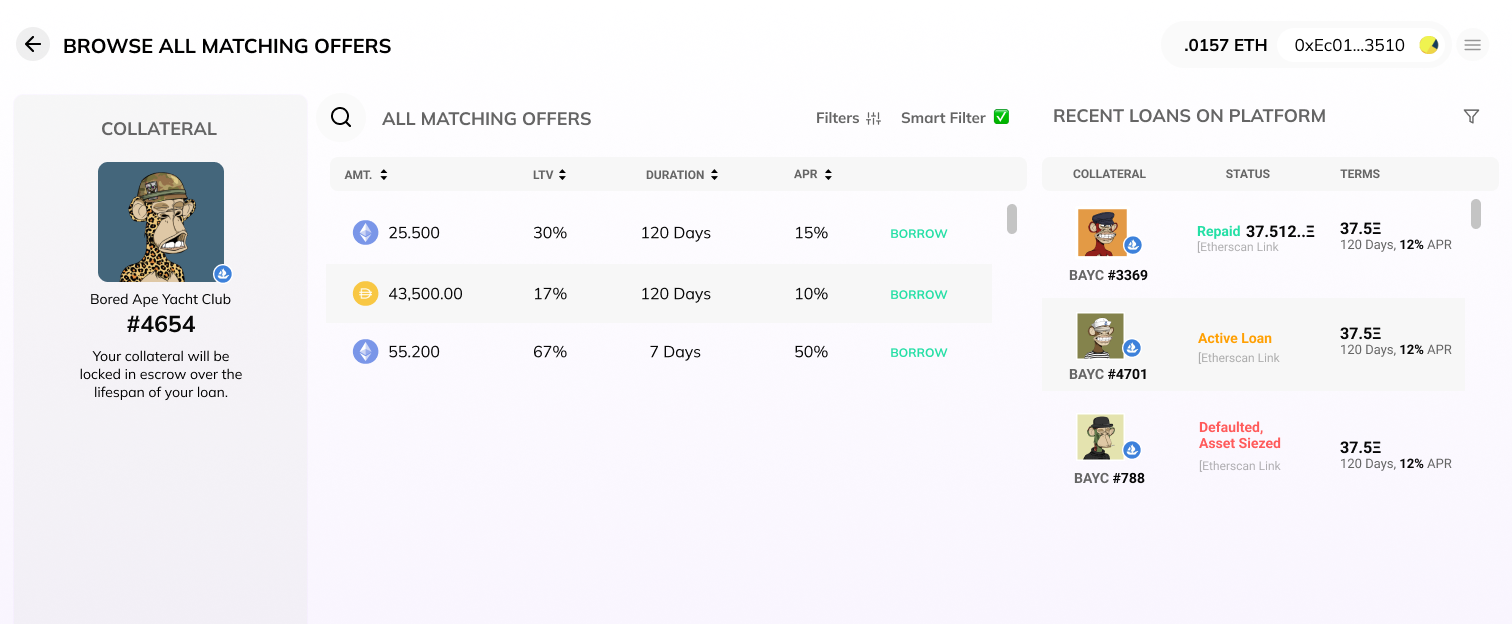

Borrowers have the option to execute any loan in the NiftyApes offer book.

Once the borrower initiates a loan offer, the loan terms are displayed to the borrower. The borrower has to initiate two transactions.

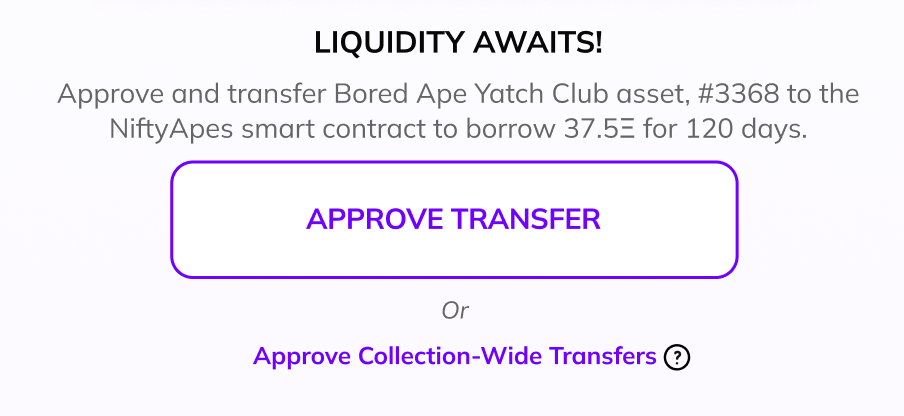

1. The first transaction approves the NiftyApes contract to transfer the NFT being used as collateral.

2. The second transaction transfers the NFT to NiftyApes smart contract, and transfers the liquidity from the NiftyApes protocol into the borrower's wallet.

Then we celebrate! A new loan has been initiated on the NiftyApes protocol.

How does lending work on NiftyApes?

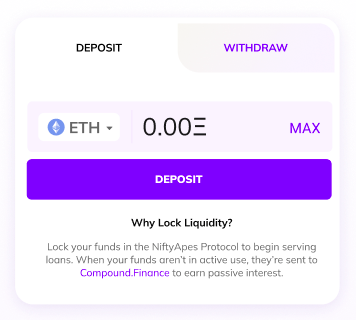

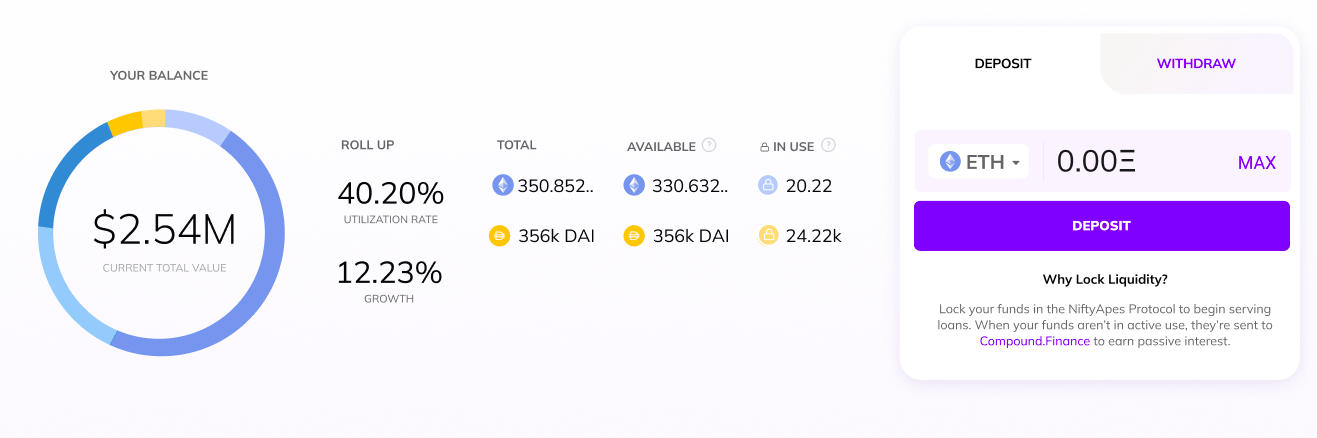

Lenders lock liquidity into the NiftyApes protocol. Locked funds are deposited into Compound and earn interest passively while not utilized in active loans.

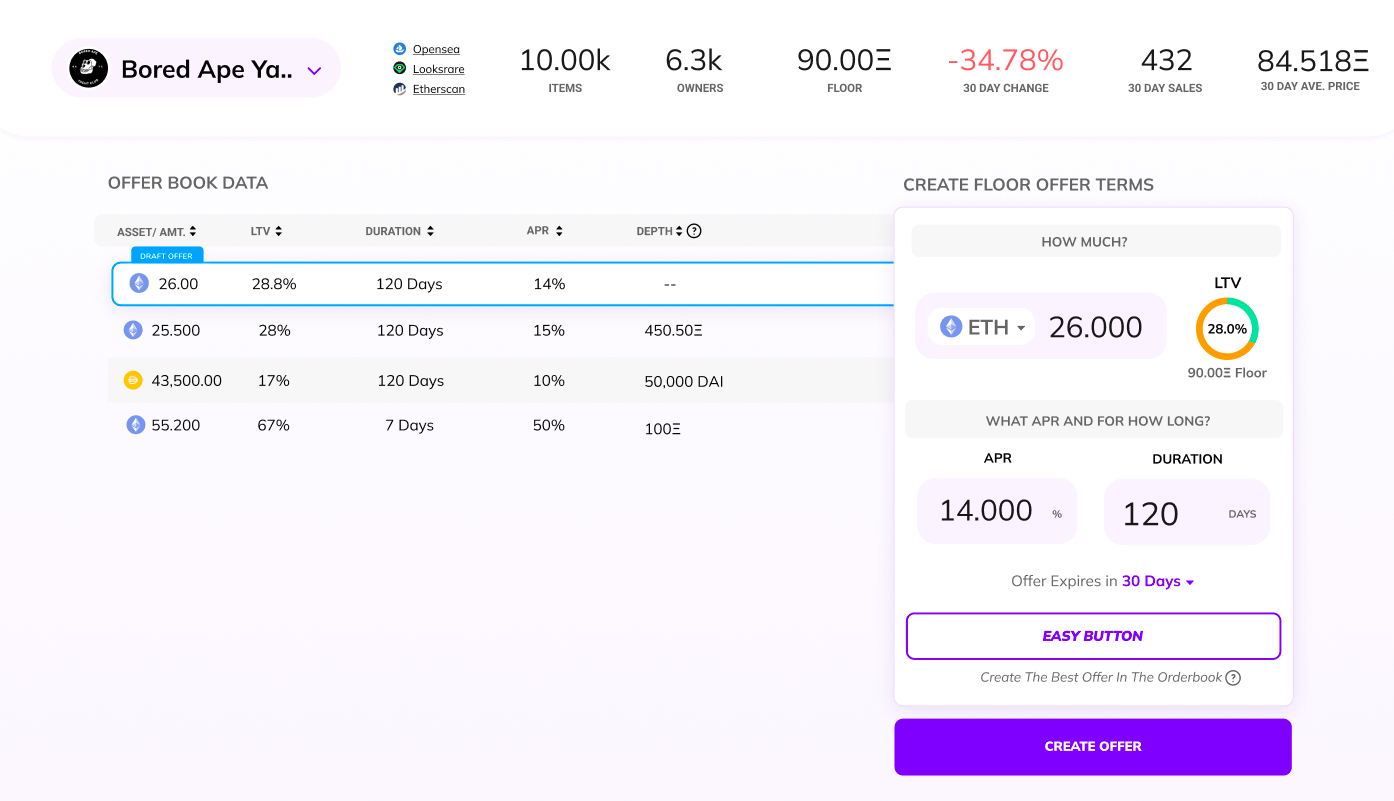

Lenders can then create and sign offers on collections or specific assets within a collection.

Those offers are added to the NiftyApes offer book and displayed to borrowers.

Can I cancel an offer after I've made it?

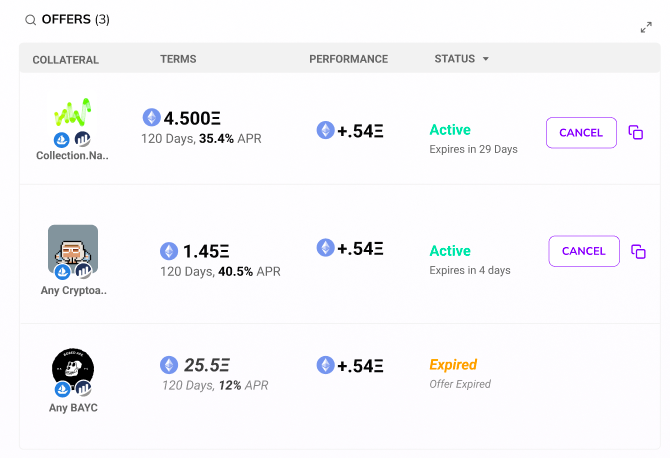

Up until a borrower has executed a standing loan offer, a lender has the option to cancel the offer at any time.

Once the offer is taken by the borrower, the lender cannot cancel the loan, and must wait until the duration completes to either receive the liquidity or, in the case of default, the collateral back.

What happens to offers that don't have any liquidity left?

Standing offers that don't have liquidity backing them are hidden on the NiftyApes front-end.

If an offer is submitted on-chain that does not have backing liquidity, the transaction fails, and the NFT is returned to the borrower.

How is interest calculated?

APR is calculated per-second. Payments made before the end of the loan reduces the total interest owed by the borrower.

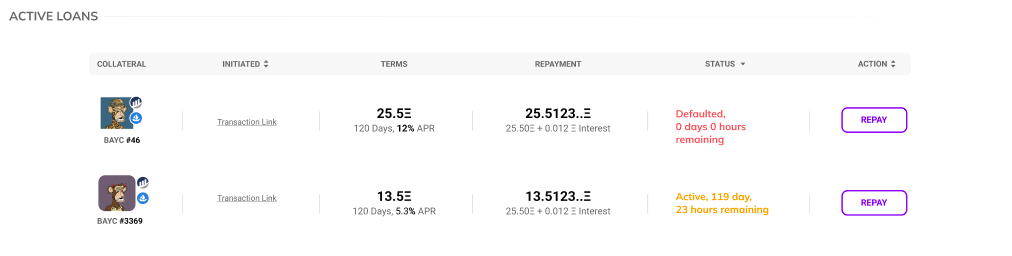

How does repayment work?

Up-to-the-second interest is calculated and displayed on the Borrower's Dashboard. Borrowers can initiate a loan payback on their dashboard.

The amount to repay on the front-end calculated as Interest Accrued Up To that Point + a buffer in case of network congestion.

Any overspend is returned to the user along with the NFT once the transaction goes through.

Is there a minimum time for a loan?

Yes! There is a 24-hour minimum loan duration enforced at the smart contract level. We did this to protect borrowers from getting scammed - no loans for 1 second to auto-seize valuable assets.

The borrower can always pay the loan back before the 24 hours is up, but the lender cannot offer terms any shorter than 24 hours.

How are loans refinanced?

The front-end is still in development and is currently unavailable on the dApp. Trust us though, it's going to be slick when it's launched.

How am I earning APY when my liquidity isn't in use?

When funds that have been deposited into the NiftyApes protocol are not in use for active loans, they are deposited into Compound and earning an industry-standard yield.

Any COMP rewards earned on liquidity are transferred to the NiftyApes protocol with the intention of funding future development, community and grants.

What happens if the borrower defaults?

Lenders seize the underlying collateral (NFT). They can do so either via the front-end...

or by making the call to the NiftyApes smart contract.

seizeAsset( collectionAddress, nftID)

Have more questions? Check our our documentation or join our Discord and let us know what we missed!